nj property tax relief for veterans

Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their. Talk through your unique home financing situation goals and options with a Veterans United loan specialist.

Tax Break For Disabled Vets Who Own Coops Nj Spotlight News

Local Property Tax Relief Programs.

. NJ offers a property tax exemption for senior citizens disabled persons and their surviving spouses. About the Company Nj Property Tax Relief For Veterans. 250 Veterans Property Tax Deduction Effective December 4 2020 State law PL.

To qualify for this exemption you need to. Applications for the homeowner benefit are not available on this site for printing. Be 65 or older.

New Jerseys Property Tax Relief Programs. The state of New Jersey provides several veteran benefits. Annual deduction of up to 250 from property taxes due for qualified war veterans or a veterans who served in peacekeeping missions and.

Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption. You can also apply if you are. NJ Division of Taxation - Local Property Tax 100 Disabled Veteran Property Tax Exemption Effective December 4 2020 State law PL.

You are eligible for a 6000 exemption 3000 for Tax Years 2017 and 2018 on your New Jersey Income Tax return if you are a military veteran who was honorably discharged or released under honorable circumstances from active duty in the Armed Forces of the United States on or any time before the last day of the tax year. 413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction. Local Property Tax Forms.

On your tax liability and nj property tax relief for disabled person even nontraditional medical and. Must be 100 permanently disabled or over age 65 with less than 12000 in annual. Property Tax Relief Forms.

Here is a list of property tax exemptions available to disabled Veterans in each state. At least 14 days in a combat zone are eligible for an annual 250 property tax deduction. If you are 65 or older or disabled and have lived in New Jersey for at least one year you may be entitled to a 250 property tax deduction each year.

Property Tax Relief Programs Property Tax Relief Programs Attention ANCHOR Applicants The deadline for filing your ANCHOR benefit application is December 30 2022. It was founded in 2000 and is a member of the American Fair Credit. Annual Deduction for Veterans.

Civil Union Act Implementation. Military veterans who were honorably discharged or released under honorable circumstances are eligible for a 6000 exemption on New Jersey Income Tax returns. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met the income limits.

The ballot question which passed with 76 of the vote makes veterans eligible for a 250 property tax deduction regardless of whether they served during a. About the Company Property Tax Relief For Veterans In Nj CuraDebt is a company that provides debt relief from Hollywood Florida. 413 eliminates the wartime service.

Not specific to veterans. It was founded in 2000 and has since become a member of. CuraDebt is a debt relief company from Hollywood Florida.

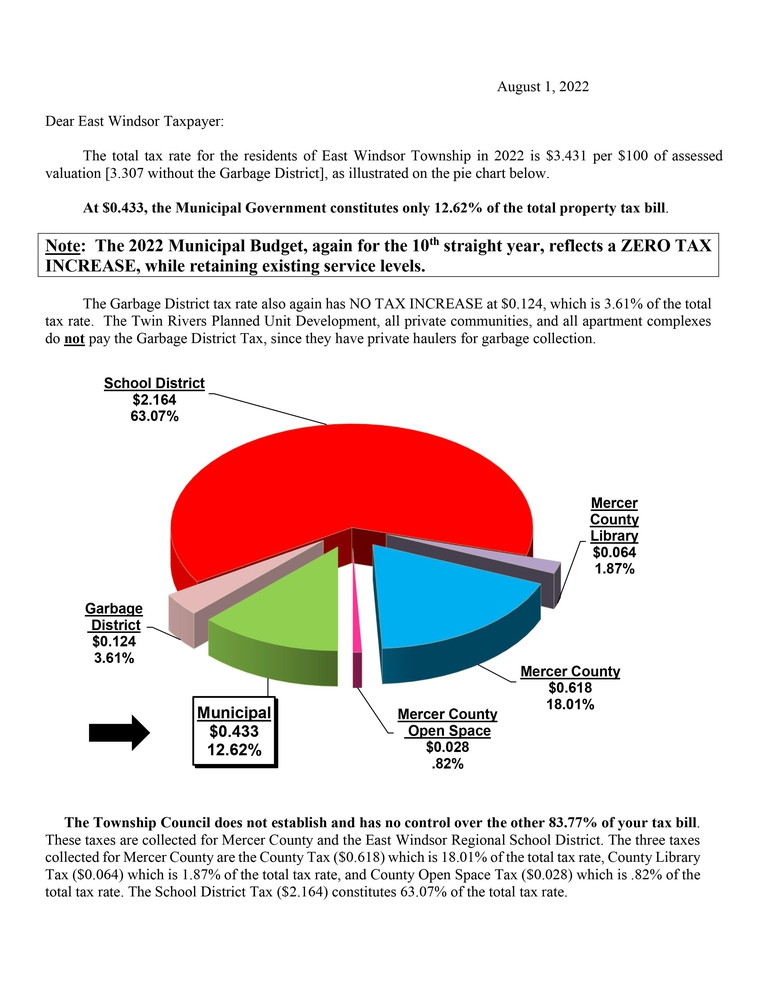

Official Website Of East Windsor Township New Jersey Tax Collector

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

New Jersey Voters To Decide On Tax Breaks For Peacetime Military Veterans Echoes Sentinel News Newjerseyhills Com

Nj Ballot Question On Veterans Property Tax Relief Nj Spotlight News

Gopal Resolution To Extend Eligibility For Veterans Property Tax Deduction And Exemption In Continuing Care Retirement Communities Advances Nj Senate Democrats

Tax Assessment And Collection News Announcements West Amwell Nj

Election 2020 Voters Approve Stronger Veterans Tax Deduction Nj Com

Property Taxes By State How High Are Property Taxes In Your State

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Veteran Services Passaic County Nj

Property Tax Calculator Smartasset

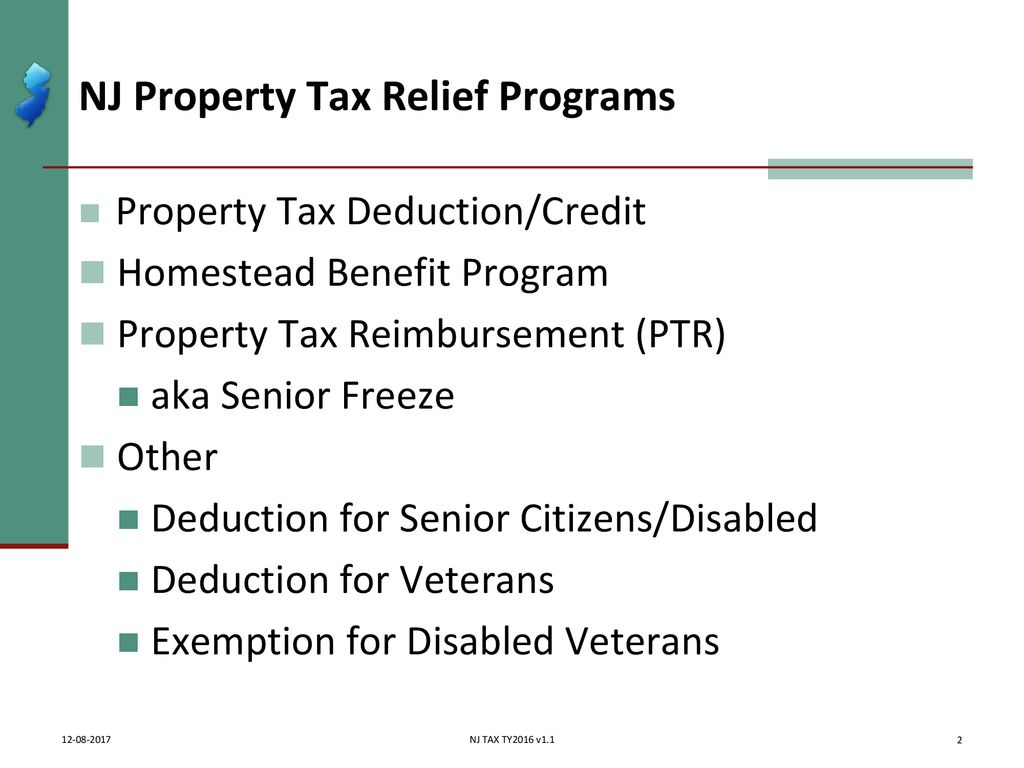

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Nj Voters Expand Property Tax Help For Veterans Here S How To Apply

State Of Nj Department Of The Treasury Division Of Taxation

Nj Oks Veterans Property Tax Deduction Election 2020 Results

Nj Division Of Taxation Important Update If You Are A Veteran Service In Wartime Is No Longer Required In Order To Be Eligible For The 250 Veterans Property Tax Deduction Or

Apply For Nj Anchor Tax Relief This Fall Montgomery Township New Jersey